Understanding Affordable Home Schemes in the UK

Home ownership is a key aspiration for many individuals, yet the rising cost of property makes this goal difficult to achieve. However, with the right resources and guidance, navigating through affordable home schemes can be easier. Let’s uncover how.

Here are key aspects you need to understand about affordable home schemes:

- Assessing Your Income and Savings: Understanding your own financial capacity is crucial when entering into affordable housing schemes.

- Prioritising Scheme Applications: Different schemes have distinct eligibility criteria, so knowing where you qualify is essential.

- Exploring Various Housing Schemes: A wide array of housing schemes exist, catering to different demographics and needs.

- Tax Relief and Mortgages: Understand the implication of stamp duty tax relief and mortgage guarantee on your financial commitment.

- First Homes and Shared Ownership Options: These options provide an avenue to own a part of the property and gradually increase your share over time.

Determined planning can make owning a property more accessible through affordable home schemes.

Navigating Affordable Home Schemes

In my journey to becoming a homeowner, I’ve drawn inspiration from entrepreneurs who have paved the path before us. They too, started with just a dream and faced challenges head-on. One place where I found these stories is at smallbusinessmonitor.net.

The resourcefulness of entrepreneurs, similar to exploring affordable home schemes, involves understanding strategic moves, keeping an eye on opportunities, and seizing them when they arise.

It’s all about making informed decisions, understanding the process, and having persistency.

In a way, seeking an affordable home scheme is another venture where patience, insights, and careful choices can turn dreams into reality.

Contents

- Assessing Your Income and Savings

- Prioritisation of Scheme Applications

- Exploring Various Affordable Housing Schemes

- Stamp Duty Land Tax Relief and Mortgage Guarantee

- First Homes and Shared Ownership Options

- Right to Buy and Help to Build: Equity Loan

- Essential Documents for Application

- Decoding Affordable Homes

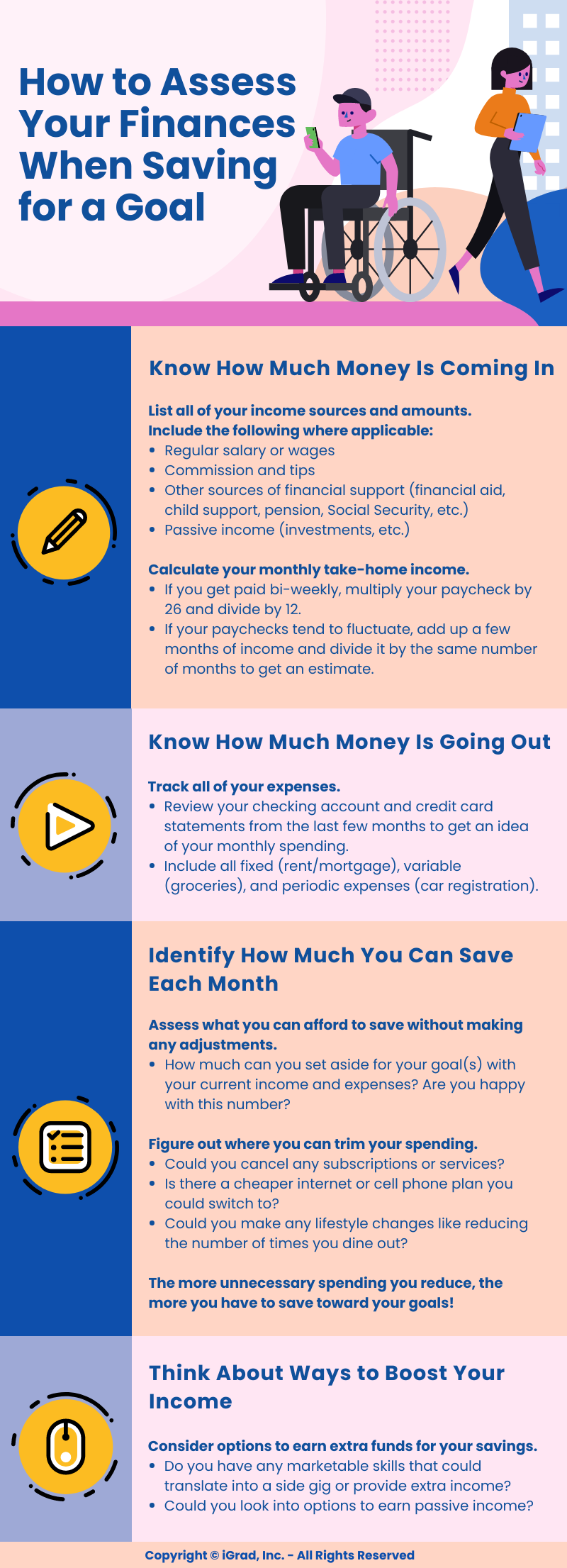

Assessing Your Income and Savings

Before considering affordable housing schemes, assess your income and savings.

Determining Your Financial Standings

Aim for precise understanding of how much you can reasonably afford to spend on a home.

Account for regular expenses, potential future costs, and desired lifestyle or savings goals.

Harnessing Reliable Resources

Consider using online calculators or spreadsheets as they can assist in giving a clearer picture of your finances.

Formulating Sensible Budgets

It’s essential to form an effective budget that aligns well with your earning capabilities.

This will ensure your loan repayments won’t compromise other monetary commitments or lifestyle needs.

Note the importance of having some savings aside for unexpected costs that inevitably arise when owning a home.

Maintaining Realistic Expectations

Aiming for homes within your financial reach will alleviate unnecessary stress and protect your economic security.

Each individual’s circumstances differ but sensible planning ensures affordable property ownership is achievable, regardless.

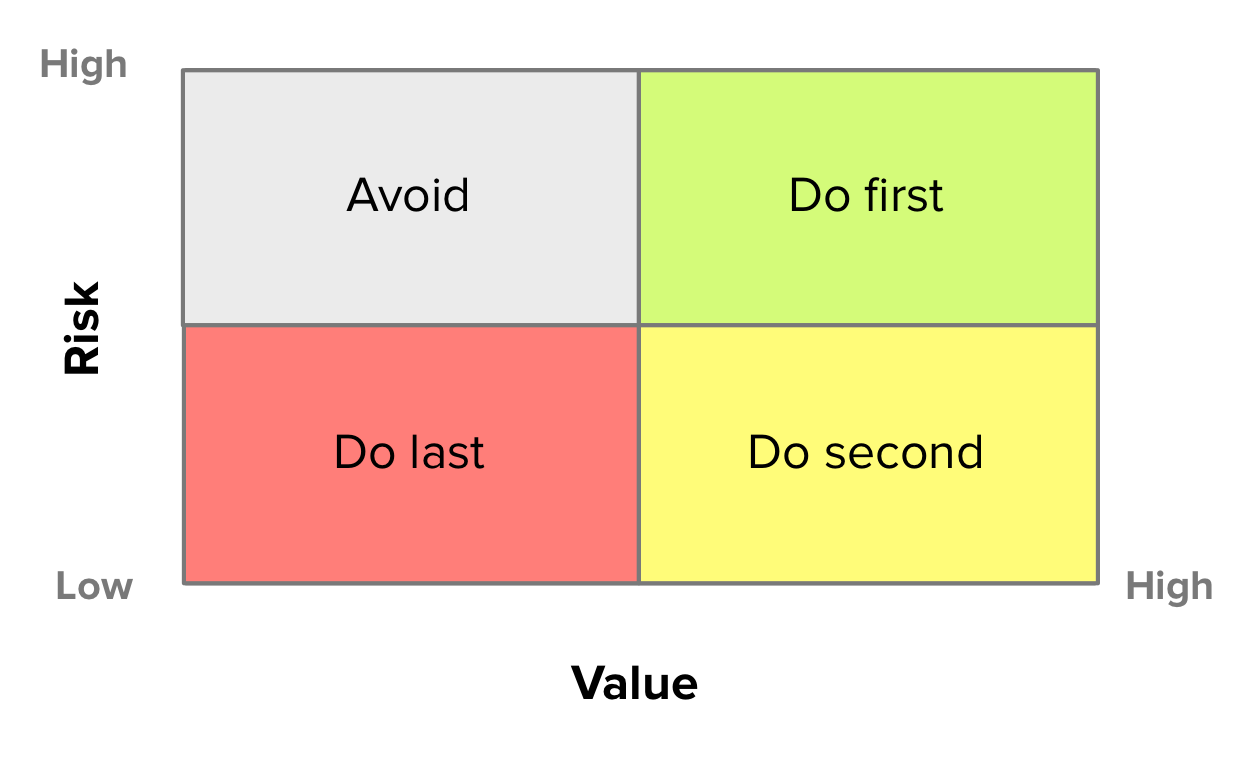

Prioritisation of Scheme Applications

When applying for affordable home schemes, prioritization is a paramount aspect.

Every application is analysed based on your needs and situation.

The intention is to ensure the support is provided where it’s most needed.

This thoughtful approach helps foster an inclusive society.

This form of strategy targets those with the most pressing housing issues.

It ensures the efficient usage of available resources.

Those in dire need of housing receive assistance first.

This includes individuals displaced due to unforeseen circumstances.

An evaluation process determines eligibility to avoid misuse.

Further readings offer more in-depth insights into this process.

Last but not least, it empowers people by providing accessibility to housing.

Exploring Various Affordable Housing Schemes

Affordable housing schemes provide various options for individuals and families. They aim to offer economical solutions while ensuring stable accommodation.

These programs come in many types, each tailored to a specific demographic. These may include first-time homeowners, low-income earners or senior citizens.

- Acknowledging Eligibility : Since these initiatives are demographic-specific, one must first understand which scheme suits their needs and status.

- Understanding Benefits : Each program offers unique advantages. Some may offer reduced interest rates on home loans, whereas others may waive deposit fees.

- Filing an Application : Once eligibility and benefits are clear, application for the program is the next step. Proper documentation and adherence to the application process can increase chances of approval.

In addition to these steps, it’s crucial to consider other elements like location, quality of housing within budget and room for potential value appreciation.

About the application process, thorough preparation matters. Missteps could possibly lead to rejection.

Explore these schemes thoroughly. Arm yourself with knowledge and prudence, find the best possible solution catered to your needs for affordable housing.

Stamp Duty Land Tax Relief and Mortgage Guarantee

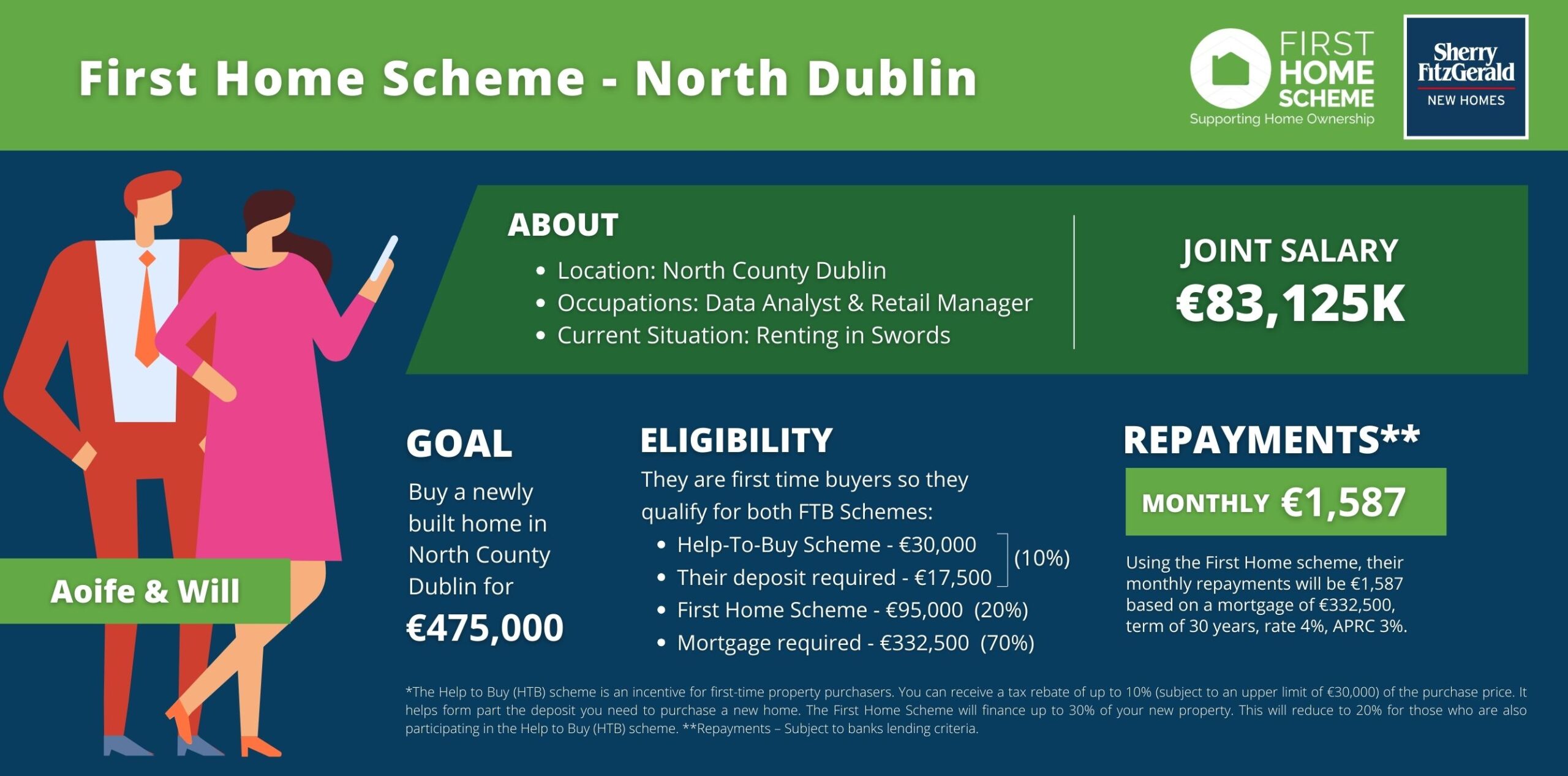

If you’re a first-time home buyer, you’re likely to be eligible for Stamp Duty Land Tax (SDLT) relief. This significantly reduces the amount of tax you need to pay upon purchasing a property. Explore this and several related factors with me today.

- SDLT tax brackets: The tax changes based on your property’s price bracket. Knowledge of these brackets can help make informed decisions.

- Mortgage guarantee scheme: This UK government scheme aids first-time buyers to afford a property by just saving 5% deposit.

- Temporary SDLT relief: Many may benefit from temporary relief measures put in place due to recent circumstances.

- Exemptions for first-time buyers: As a new buyer, you have more opportunities for exemptions and reductions in SDLT.

Navigating the complexities of home buying can be daunting, especially with laws and policies such as SDLT. You don’t have to figure it all out alone; resources exist to assist you.

To better understand SDLT and how it may affect your purchase, take a look at this comprehensive guide.

Parsing through the intricacies of these policies could be the key to unlocking the door to your new home without draining your wallet.

It’s crucial not just to know about these policies but also understand them fully. Knowing every detail might save substantial money when purchasing a property.

If you’re a first-time homebuyer, you have ample home-buying choices available to you.

The First Homes initiative, a notable option, aims to make houses more affordable for prospective homeowners.

| Home Buying Scheme | Description | Advantages |

|---|---|---|

| First Homes | An initiative providing discounted rates for homes to local people, key workers, and first-time buyers. | Properties are offered at a significant discount, making it easier to get into the property market. |

| Shared Ownership | This enables you to buy a part of a house and pay rent on the rest. | This reduces the initial deposit amount and makes monthly payments more manageable relative to outright purchase. |

| Help to Buy Equity Loan | A government scheme that helps with the down payment on newly built homes. | The loan is interest-free for the first five years, easing early financial strain. |

Please refer to this trusted resource from the Citizen’s Advice Bureau in the UK for further details on these home buying schemeshere.

You’ll find elucidative advice assisting your decision-making on essential factors like budget, location, and type of property. Make an informed choice that suits your needs and offers value.

Right to Buy and Help to Build: Equity Loan

The Right to Buy scheme grants tenants the opportunity to acquire their rented property at a discounted price.

However, obtaining the necessary resources for homeownership may be a hurdle, especially for first-time buyers.

In light of this, the Help to Build: Equity Loan programme has been designed as a solution.

- This provision offers interest-free loans for the first five years. Such loans can cover up to 20% of the property’s value outside London and up to 40% within London.

- Borrowers need only raise a 5% deposit on their own and secure a repayment mortgage for the remaining amount (up to 75%).

- The loan proves beneficial as it allows individuals to buy homes with smaller deposits and lower mortgage repayments.

This scheme enriches lives through its provision of financial assistance tailored specifically towards enabling homeownership.

The guidelines assert that the aforementioned loans are only available for new build properties purchased from participating builders.

If you fulfil the criteria, don’t let finance hinder your dream of owning a house.

Essential Documents for Application

Applying for affordable home schemes demands diligence and proper organization.

Dearth of mandatory documentation can lead to futile endeavors.

The initial documents you’ll need include proof of identity and proof of income details.

These are core requirements for most home schemes.

| Type of Document | Purpose |

|---|---|

| Proof of Identity | To validate the applicant’s identity and confirm eligibility |

| Proof of Income | To assess the financial capabilities of the applicant |

| Bank Statements | To provide additional assurance regarding the applicant’s financial status |

| Employment Verification | To demonstrate a stable source of income for the applicant |

| Table: Essential Documents for Application. | |

Your application gains credibility with thorough document presentation.

Credit reports are another essential part of your application, as they depict your reliability as a debtor.

.

Your credit history would most likely influence the decision on your application.

.

Meticulously arrange these documents to amplify chances of successful applications.

.

Decoding Affordable Homes

In the UK, affordable home schemes play an essential role in addressing housing issues. These schemes, including Shared Ownership, Help to Buy, and others, provide a stepping stone for those struggling to get on the property ladder. A better understanding of these schemes can empower potential homeowners to make informed decisions, thus making the dream of owning a home more attainable.