Practical Steps to Buying Property Without a Realtor

Real estate investment can be complex, especially when you’re new to buying property. It’s important to understand the process and steps involved before making your first purchase.

Today, we’re going to delve into the key aspects you should consider when purchasing real estate, and provide actionable tips to ensure a smoother process.

- Assessing Readiness: Ensure you are prepared for this significant financial commitment.

- Defining Budget: Determine your budget based on your financial circumstances.

- Identifying Properties: Identify potential properties that fit your needs and budget.

- Evaluating Finance Options : Understand your financing options and identify which is most suitable.

- Negotiating Offers: Learn to negotiate effectively when making property offers.

- Obtaining Homeowners Insurance: Protect your investment by acquiring a comprehensive home insurance policy.

These basic principles will set you on the path of a successful real estate acquisition. To delve deeper into these components, I recommend discovering how successful business individuals approach these processes. For instance, studying the traits of successful entrepreneurs can often shed light on new methods and innovative thinking styles that can be applied in buying property.

Finding Inspiration in Successful Entrepreneurs

To better understand this concept, this article discusses various entrepreneurial traits from icons like Walt Disney to local house buyers around the world. It could offer valuable insights as you embark upon your property buying journey.

In conclusion, investing in real estate requires thorough preparation, understanding your budget, identifying appropriate properties, and protecting your investment with insurance.

Applying the traits and strategies of successful entrepreneurs could significantly enhance your property buying process.

Remember, every real estate journey is unique; what works for some might not work for you, but these tips should give you a good starting point.

Contents

1. Assess Your Readiness

Purchasing real estate requires thorough preparation. Begin by evaluating your financial stability, personal needs, potential risks, and potential rewards.

Your financial health is paramount. Evaluate your savings, income, and credit score to understand your purchasing power.

Personal Needs Evaluation

Consider lifestyle factors like housing needs, location desire and long-term goals. Be mindful of how your property preference aligns with these.

Identifying Risk Factors

Real estate investments aren’t without risks. Consider factors like market dynamics and interest rates that could potentially impact your preset budget.

Projecting Potential Rewards

The potential return on investment should justify your decision. Analyze if the property’s appreciation rate outweighs its maintenance costs, taxes, and mortgage payments.

Your readiness extends beyond just the fiscal aspect. It involves comprehensive research that enables you to make informed choices.

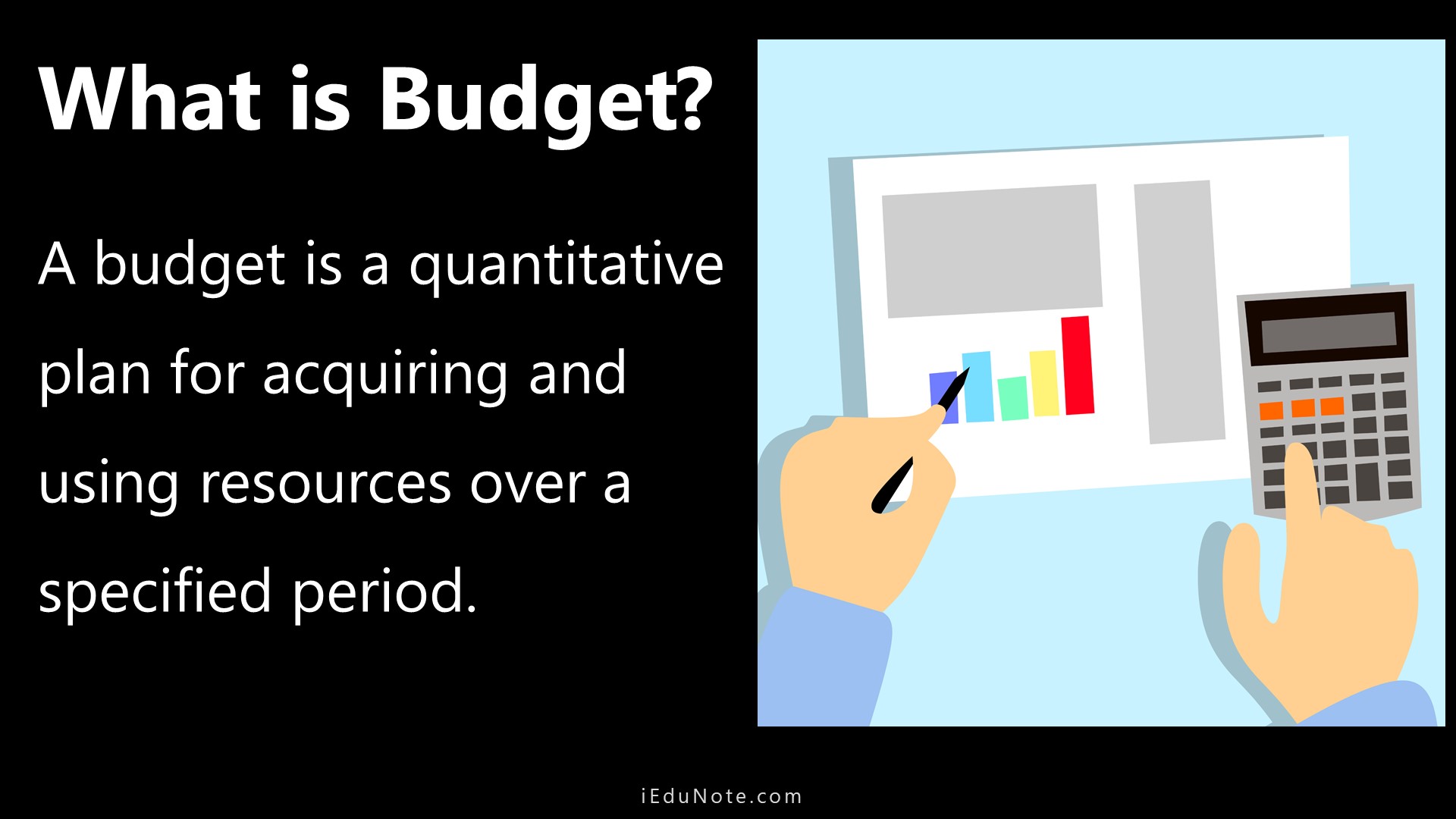

2. Define Your Budget

Defining your budget is a crucial step.

It sets the boundaries for your property search.

Also, it helps avoid financial hardships down the line.

The Importance of Financial Planning

Thorough financial planning helps to identify your price range.

This includes considering your income, savings, and expenses.

Ensure there’s a balance across all these elements.

Identifying Potential Costs

Beyond purchasing price, consider other potential costs.

These may include property taxes or homeowners insurance.

Maintenance costs may also arise over time.

Seeking Expert Advice

You may also seek expert advice when setting your budget.

This could help you plan better and avoid pitfalls.

Sometimes, an outside perspective could offer invaluable insights.

3. Identify Suitable Properties

Identifying apt properties requires careful attention to various factors.

Craft a wishlist of essential elements in your desired home.

Think beyond aesthetics, including aspects like location and neighbourhood.

Consider proximity to amenities, transport links and local schools.

Look for properties in a state of good repair to avoid out-of-pocket expenses later on.

“A keen eye for detail can prevent unforeseen costs and preserve your investment.”

Your preferred property type would also play a crucial role in your search. It could be a condo, a townhouse or a detached house.

Carefully weigh pros and cons of each before committing to any one particular type.

A real estate agent might be useful; however, learning to navigate listings can make you more self-sufficient.

4. Evaluate Financing Options

When buying property, it’s crucial to evaluate your financing options. Understanding these choices provides a financial foundation for this significant investment.

Typically, these options range from traditional loans to more innovative solutions. Ensuring you understand the nuances is paramount.

- Mortgages: These are often the go-to option for many when purchasing property. Do thorough research on different types and their specific conditions.

- Investor Financing: For those making investment purchases, this can open up various avenues not commonly found in traditional lending structures.

- Property Swap: This involves trading one piece of real estate for another, more often done when two parties have properties of similar value.

- Bridge Loans: This temporary loan may be a possible solution for some who need interim financing before their primary loan finishes processing.

The main goal is finding the best financing option tailored to your needs. It’s critical to study each option’s pros and cons.

Picking the correct avenue can save you money over time and create a smoother purchasing journey. Nonetheless, always get advice from a financial advisor before making any decisions.

5. Obtain Pre-Approval

Before delving into the property marketplace, you need to obtain pre-approval. This process involves lender assessment of your finances to decide a loan amount you can borrow.

- Review Your Credit Score: Lenders consider this when determining your pre-approval limit. Regular monitoring and improving your score is beneficial.

- Determine Your Budget: Understand your financial strength, calculate what you can afford before approaching lenders for pre-approval.

- Gather Documents: Pre-approval necessitates certain documents covering employment, income and assets.

The next step is submitting your application to the lender. Efficiency during this stage will boost your chances of securing pre-approval faster.

Achieving pre-approval not only puts you at an advantage during property negotiations but also fast-tracks final loan approval. You’ll also gain insight into potential payment plans through the Bankrate website.

Last but not least, it’s paramount to keep regular tabs on your pre-approval status due to its time-sensitive nature.

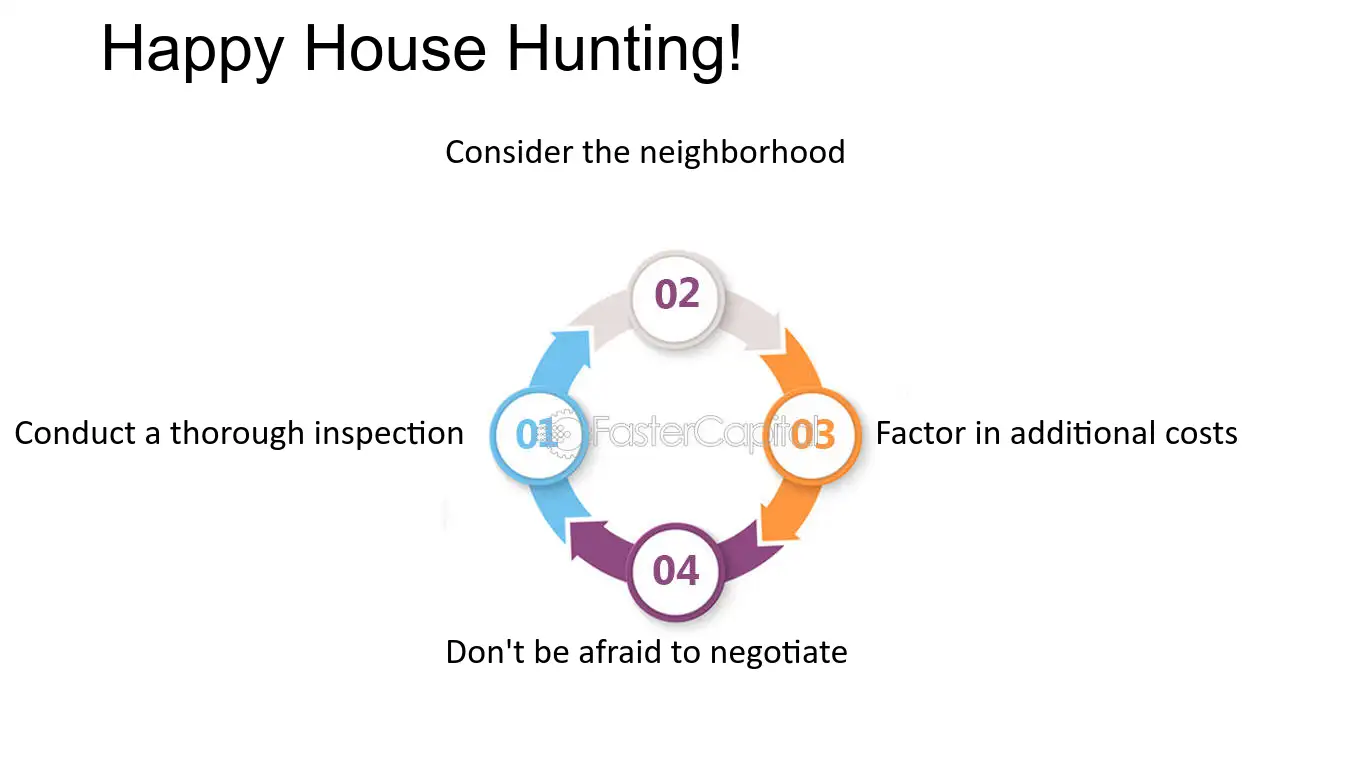

6. Conduct House Hunting

The thrilling journey of house hunting commences at this stage. It’s an opportunity to explore various property options that suit your preferences.

Consider factors like location, community, and proximity to amenities. These will ensure the property meets your daily needs and lifestyle targets.

Investigate the property’s condition thoroughly. This will save you from potential structural issues which can result in large costs in the future.

A proper investigation also assists you in snapping a good deal since you can negotiate the price based on your findings.

Have a wish list for your future home. This helps you avoid getting sidetracked by properties that don’t meet the items on your list.

Stay flexible, though, as it’s nearly impossible to find a house that checks every box on your list. You may have to make some compromises.

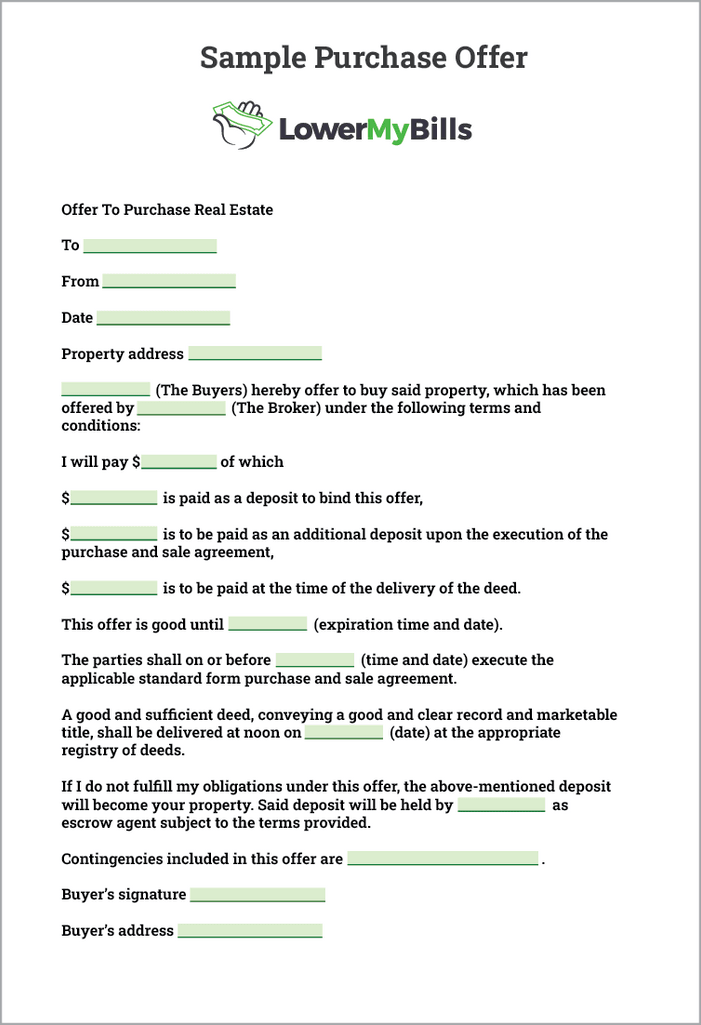

7. Make a Property Offer

Once you’ve done thorough research and found a house you love, it’s time to make a property offer. This is a crucial part of the home-buying process.

The art of submitting an offer varies significantly, with several critical aspects to take into account:

- Determine Your Opening Bid: Perform comparative analysis using similar properties to gauge the right price.

- Review the Seller’s Position: Know if the seller is in a hurry to sell. This information can provide leverage during negotiations.

- Consider Home Inspection Reports: Be mindful of issues flagged in the home inspection report and use them during price discussions.

- Evaluate Other Bids (if any): Understanding your competition can help craft a more convincing bid.

The offer should be reasonable and fair, avoiding insultingly low bids that could breach the rapport with the seller.

This complex task can be made easier by leveraging real estate platforms like HomeFinder, who have comprehensive databases of properties along with robust systems that guide potential buyers through the process of generating an accurate property offer at fair market value.

Having robust negotiation skills will work in your favor, and being flexible and patient can go a long way during this process.

A well-thought-out strategy to make an effective property offer goes beyond just naming your price: tailor your conditions to the sellers’ needs for results that benefit both parties.

8. Secure Your Mortgage

How Can I Secure a Mortgage?

To secure a mortgage, ensure you have a good credit score to start with.

This improves your chances of approval when applying.

What If My Credit Score Is Not Good Enough?

Don’t fret if your credit score isn’t up to par.

You can still obtain a mortgage by improving your financial stability and reducing any outstanding debts.

What Role Does Financial Stability Play in Securing a Mortgage?

Your financial stability plays a key role in the eyes of lenders.

A stable income signifies less risk, increasing the likelihood of mortgage approval.

How Do I Improve my Financial Stability?

To show financial stability, maintain a steady job, pay bills in time and reduce your debt-to-income ratio.

Are There Different Types of Mortgages?

Indeed, there are several types of mortgages available to fit everyone’s needs.

Dive into some research or consult a professional to understand which type would work best for you.

Here’s an interesting resource about different kinds of mortgages. Be sure to consider your specific situation before making a decision.

Is It Possible to Secure A Mortgage Without 20% Down Payment?

Yes! It is possible to secure a mortgage with less than 20% down payment.

This would require you to pay for private mortgage insurance (PMI).

What Is PMI and How Does It Impact Me?

Private Mortgage Insurance (PMI) is an additional cost implemented when you put down less than 20% on your home.

It protects the lender in case you default on your mortgage.

9. Acquire Homeowners Insurance

One of the essential steps in home-buying is acquiring homeowners insurance. It offers financial protection if certain unfortunate events should occur.

You must invest time in understanding the different types of homeowners insurance policies available to make better-informed choices.

| Type | Coverage |

|---|---|

| HO-1 | basic form of coverage against common perils |

| HO-2 | covers more perils than HO-1, specified in the policy |

| HO-3 | broad policy including coverage for all perils except those specifically excluded |

| HO-8 | created for older homes, covers fewer perils and pays out only actual cash value of damages |

| Coverages may vary depending on provider and location. | |

Each policy type comes with its own advantages and limitations, choose wisely according to individual needs and risks.

Detailed exploration into these home insurance policies and their coverages is a worthwhile effort during your property acquisition journey.

As always, read the fine print carefully before signing any agreement; this ensures you are well-informed about all aspects of your insurance coverage.

Realtor-Free Reality

Buying a property without a realtor is entirely achievable. This process requires proper research, a clear understanding of the real estate market, patience in negotiating, and due diligence during the property inspection. With adequate preparation, one can save on significant realtor’s fees and have a direct transaction with the property seller.