Insights into American Small Business League’s Operations

To succeed in any American small business endeavor, one needs to employ strategic planning and resourcefulness. From startups initiated in basements to local mom-and-pop shops becoming nationwide franchises, the tales of American small businesses are as varied as they are impressive.

Yet, such success stories often stem from significant sacrifice. Among these sacrifices, venturing into the property market – particularly selling one’s house to fund a business – is not an uncommon occurrence. Is this a smart move? I found an insightful article on this subject, which you can access via this link.

Let’s delve into the world of American small business further with the following key points:

- History and Future Prospects: Understanding past trends and future opportunities is crucial for any American small business.

- Key Guidance Documents: Adequate knowledge increases your business’s chances of succeeding.

- ASBL’s Advocacy: Advocacies for free enterprise play a significant role in fostering growth for small businesses.

- Diversity in Ownership: A diverse ownership landscape opens up opportunities for innovation and growth.

- Innovation and Resilience: These two adjectives describe small businesses aptly during times of crisis.

- Data Analysis: ASBL’s Small Business Data Center offers essential insights into the small business sector.

Browsing through this list only scratches the surface of the dynamic world of an American small business owner or aspirant.

Diving Deeper

The beauty of owning a small business lies in its flexibility. Unlike massive corporations, small businesses can quickly adapt to their surroundings, resizing and re-purposing as necessary.

Understanding the past paves the way for the future. Equipped with knowledge, one can effectively maneuver numerous challenges that often plague American small businesses.

Diversity breeds innovation. As the landscape of business ownership continues to diversify, we can anticipate a wide array of groundbreaking ventures on the horizon.

Embracing technology, including AI applications and data analysis tools, becomes increasingly crucial for small businesses wanting to stay competitive in our ever-evolving world.

Contents

- SBA’s History and Future Prospects

- Key Guidance Documents and Regulations

- ASBL’s Advocacy for Free Enterprise

- ASBL’s National Impact Analysis

- The Resilience and Innovation of Small Businesses

- Diversity in Small Business Ownership

- AI Usage in Small Businesses

- ASBL’s Small Business Data Center

- Decoding ASBL’s Functioning

SBA’s History and Future Prospects

Founded in 1953, the U.S. Small Business Administration (SBA) is an independent federal agency striving for the welfare of small businesses.

The mission of SBA remains assisting, counseling, and protecting these enterprises to help maintain the strength of our nation’s economy.

Notably, President Dwight Eisenhower established the SBA by signing the Small Business Act on July 30, 1953.

By the following year, SBA began providing original and guaranteed loans for such businesses.

“SBA works to ignite change and spark action so small businesses can confidently start, grow, expand, or recover.”

The SBA also assisted small businesses impacted by natural calamities and helped them secure government contracts.

In 1958, the establishment of the Small Business Investment Company (SBIC) Program addressed small business financing issues identified by a prior study conducted by Federal Reserve in 1957.

SBIC offers vital support to high-risk small entities through long-term equity investments and debt.

Understandably, SBA strives to fulfill its commitment towards fostering economic growth and supporting entrepreneurs by consistently evolving its ways.

Its dedication lies in updating services to meet business demands and leveraging technological advancements for more efficient processing techniques.

Further details elucidate how SBA is envisioned to expand its outreach programs radically.

The SBA’s future includes strategies to enhance digital customer experiences and promote data-driven services for a more targeted approach.

This single-minded aim is directed towards driving growth, improving efficiency, and heightening retention among both stakeholders – small business owners and banking institutions alike.

Key Guidance Documents and Regulations

For those interested in understanding key guidance documents and regulations, the regulations.gov provides a comprehensive repository. This includes various federal rules and helpful instruction materials.

To navigate this immense archive effectively, you would need to follow a few crucial steps:

- Document Search: This involves using an endpoint to conduct full text keyword searches.

- Date Filtering: Lets you streamline the content based on specific dates or a range of dates.

- Detailed Document Information: With specified document ID, additional attributes can be accessed.

- Searching for Comments: This enables browsing comments related to specific documents strengthening your understanding.

Apart from regulations.gov, other sites such as Department of Defense (DoD) and FDA provide essential guidance documents pertaining to their jurisdictions.

The primary value delivered by such data is its relevance and accessibility conforming to user needs, thereby facilitating informed decision making. Users can easily obtain comprehensive data ensuring a rich User Experience (UX).

ASBL’s Advocacy for Free Enterprise

Free enterprise forms the cornerstone of American prosperity and economic dynamism. Promoting this system, organizations like the Free Enterprise Alliance, spearhead issue advocacy campaigns.

- Mission: Educate stakeholders on open competition principles.

- State Engagement: Contribute to national organizations supporting 50-state legislative efforts.

- Funds Raised: Substantial funding raised for fair competition advocacy campaigns.

- Key Issues: Emphasizes open competition in government contracting, and advocates pro-growth tax system.

Citizens for Free Enterprise, another key player in this space, actively highlights small business successes and provides ready resources related to free enterprise.

- Mission: Creating a dynamic economy with American prosperity through free enterprise.

- Funding: Operates through significant individual contributions.

- Activities: Proliferating success stories of small businesses and advocating economic freedom.

The underpinning principles of free enterprise include: job creation, opportunity provision, freedom of choice and innovation preservation.

- Job Creation: Free enterprise generates necessary employment opportunities.

- Innovation: Encourages novelty and rewards inventiveness.

- Opportunity: Offers chances for elevation irrespective of wealth or status.

Aiming for better world and quality life, free enterprise paves the way for social mobility, fueled by small businesses and progressive society norms.

ASBL’s National Impact Analysis

An essential tool for policy development, impact analysis aids in the creation of robust decisions by assessing both costs and benefits of policies. It also identifies distributional impacts, ensuring based evidence.

Classes of Impact Analysis

Different types of IA frameworks are utilized by government sectors. One example is the Office of Impact Analysis which provides initial guidance on whether an IA is needed for policy pitches.

Another class is the Gender Analysis and Gender Impact Assessment Framework which mandates gender examination for all new policy proposals.

Process of Conducting Impact Analysis

The IA process involves several stages, starting with pointing out the necessity for action. This includes defining any market failure or social intention sparking the need for regulation.

Then comes analyzing costs and benefits, a process that encompasses valuation of compliance expenses, approximation of market impacts, and adjusting for inflation too.

The Significance of Impact Analysis

The importance of impact analysis in policy-making is enormous. It tailors regulations to avoid unanticipated outcomes and distortionary effects, concentrating on the potential consequences of crucial choices.

Moreover, it assists stakeholders with detailed and easy-to-understand data about governmental decisions impacting them (source).

The Resilience and Innovation of Small Businesses

Despite numerous challenges, small to medium-sized businesses (SMBs) globally have demonstrated remarkable resilience and ingenuity.

SMBs modeled many strategies from larger companies, demonstrating financial stability, organizational capabilities, and strategic focus.

Accelerating digitization, reorganizing for operational efficiency, and greater agility became necessary for survival during the pandemic.

The Covid-19 outbreak revealed striking disparities among different SMBs due to their varying capital resources and business sectors.

Despite serious disruptions, some SMBs not only survived but flourished. Their success lies in agility and resilience, attributes that helped businesses survive the 2008 global financial crisis.

SMBs need to foresee potential future crises and create a flexible operating model to ensure survival. Implementing a clear purpose and values can help businesses sustain a crisis.

Innovation is key to long-term advantage amid “creative destruction”. Over 60% of SMBs surveyed plan to increase their rate of product and business model innovation post-pandemic.

External collaborations are vital for SMBs for building an innovation advantage – closely observing customer experiences, engaging with suppliers, empowering staff, and joining local business networks can help generate new ideas.

Inspiration from thriving businesses can guide struggling ones to build resilience for the future. Those equipped with lessons from this crisis are well positioned to weather the next one.

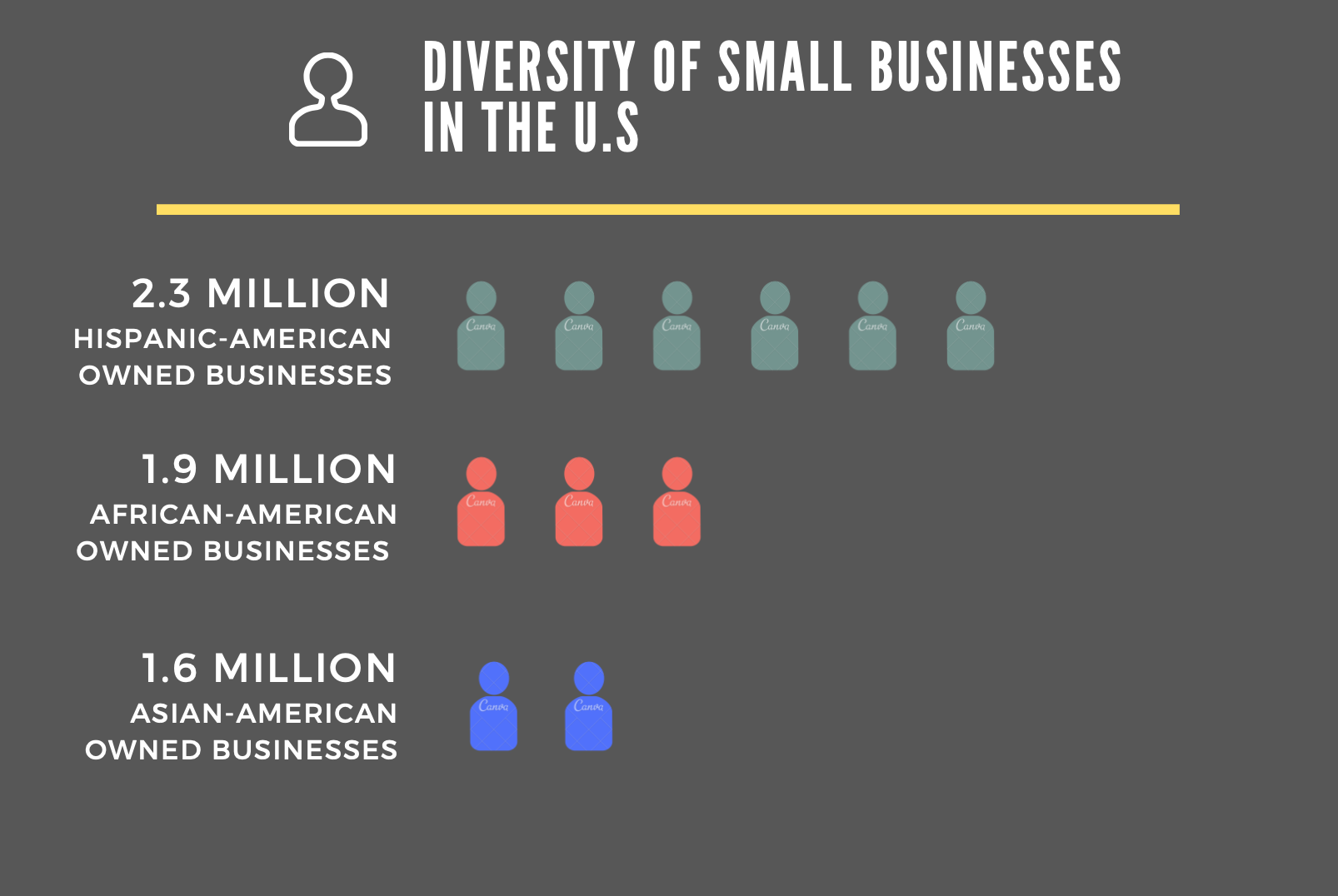

Diversity in Small Business Ownership

The current economic conditions can pose unique challenges to small business owners, especially those who identify as minorities. While obtaining capital can be tough for all, minority entrepreneurs often confront even more hurdles.

Unfortunately, minority business owners are more liable to be denied traditional forms of funding such as loans and lines of credit. This leads many to bootstrap their operations, starting with considerably less liquid wealth compared to non-minority owned businesses.

Despite these challenges, there are a variety of financing opportunities tailored to minority business owners. The following table summarizes some of these options:

| Funding Option | Description |

|---|---|

| Small Business Line of Credit | A flexible borrowing option that works like a credit card, allowing the entrepreneur to draw funds when needed |

| Private Loans for Minority Business Owners | A one-time lump sum loan with repayment over time including interest. Requirements may differ based on lenders. |

| Federal Government Funding | Programs like the 8(a) Business Development program and HUBZone help disadvantaged businesses with funding opportunities. |

| Grants for Minority Business Owners | Funds provided without an expectation of repayment. Can come from various sources including state, federal or private entities. |

| Each funding option has its own set of requirements and advantages. It is important to analyze them before making a decision. | |

Deciding on the right funding avenue depends on varying factors like loan amounts, time in business, revenue requirements and credit score standards.

Being a certified minority-owned business can also open more doors to funding. If you are applying for a specific minority business loan, carefully compare all the options available.

Help comes from not just federal programs but state-level initiatives as well, depending on your region of operation. Private businesses and corporations also provide grants.

Remember, your minority-owned status must be demonstrated during the application process. Recent documents proving your business’s status are vital. Optimum decision-making occurs when methods are compared extensively.

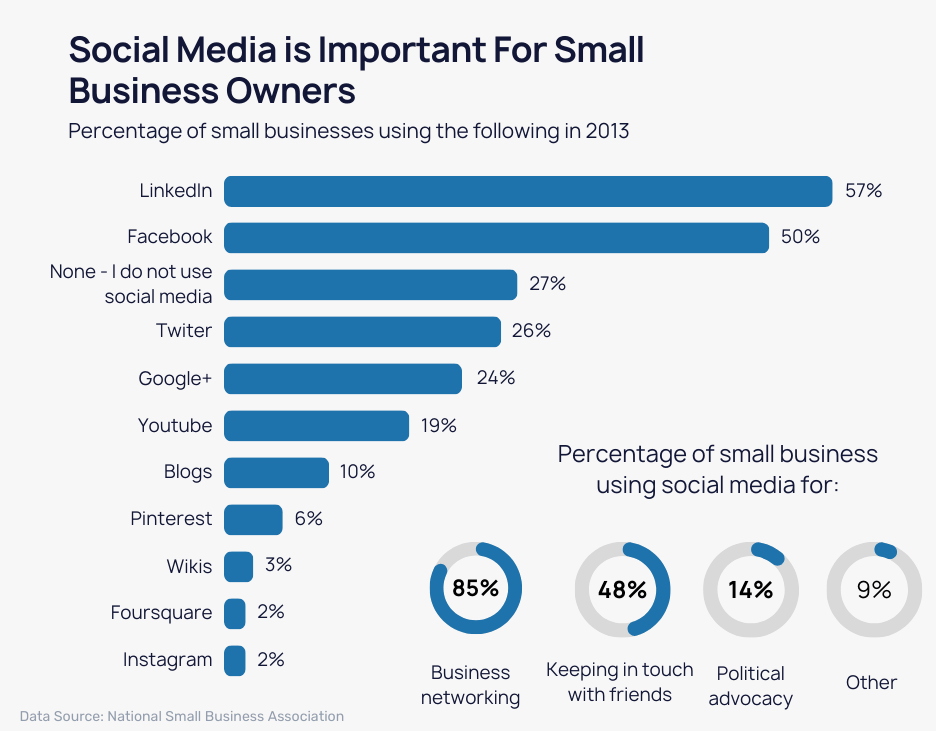

AI Usage in Small Businesses

The emerging influence of AI in small businesses is revolutionary. It’s power, if well utilized, can streamline business processes, enhance user experiences, and significantly drive growth.

Automation of Repetitive Tasks

A crucial benefit of AI use in small firms is the automation of repetitive activities. This allows staff to focus on the strategic side of the business operations while maintaining productivity.

Tasks like data entry, time scheduling, and managing inventory can shift to being handled by AI-powered software. This reduces human error and saves substantial business hours.

Optimizing Business Operations

AI provides optimization benefits when utilized for supply chain operations. Predicting demand, managing stock levels and even processing orders can be efficiently automated and executed using AI.

The predictive analytics capabilities from this disruptive technology create opportunities in financial forecasting and inventory management. Historical data plays a crucial role in making informed decisions.

Promoting Growth and Scalability

Another advantage is promoting growth by analyzing market trends and customers’ personal preferences. AI-equipped firms have a better understanding of what their target audience covets passionately.

AI-driven processes enable small businesses to expand without necessarily increasing costs associated with additional personnel. Consequently, it supports sustainable and strategic growth initiatives.

Enhancing Marketing Efforts

The use of AI-supported marketing tools sharpens customer target and maximizes the marketing ROI. Personalized recommendations complimentary to insightful chatbots improve the overall customer experience and foster loyalty.

This involvement in marketing efforts unlocks new growth opportunities by reaching customers across borders with facade-less boundaries. Hence, small businesses have an opportunity to compete effectively against larger enterprises.

ASBL’s Small Business Data Center

A key aspect of modern businesses, data centers encompass integral factors such as data storage, management and backup. They significantly power online operations and artificial intelligence computations.

Primarily, private enterprises oversee the development and operation of these data centers, with attention to power supply, environmental regulation, and security measures.

| Components | Type of Data Center | Importance |

|---|---|---|

| Servers, Storage Systems | Corporate/Enterprise Data Centers | Data Density Support |

| Networking Equipment | Colocation Data Centers | Processing Needs Support |

| Uninterruptible Power Supplies (UPS) | N/A | Avoiding Significant Outages |

| Cooling Systems | N/A | Sustaining Performance Efficiency |

| Cybersecurity Measures | N/A | Preventing Data Breaches |

| Effective data center management entails a keen understanding of potential challenges and mitigations. | ||

Hence, data centers serve as instrumental components for flourishing businesses—nurturing efficiency and bolstering security.Decoding ASBL’s Functioning

The American Small Business League’s operations offer insight into their dedication to advocacy and assistance for small businesses. Through their various programs, they aim to promote fair competition and provide resources for these businesses to thrive in the competitive U.S market. Their success lies in their effective lobbying efforts and continuous support for entrepreneurship.